SINGAPORE, October 9, 2025 – The ASEAN+3 Macroeconomic Research Office (AMRO) today released its ASEAN+3 Financial Stability Report (AFSR) 2025 and the ASEAN+3 Regional Economic Outlook (AREO) October Update, highlighting the region’s broad resilience in the face of heightened uncertainties driven by US trade policy shifts and geopolitical tensions.

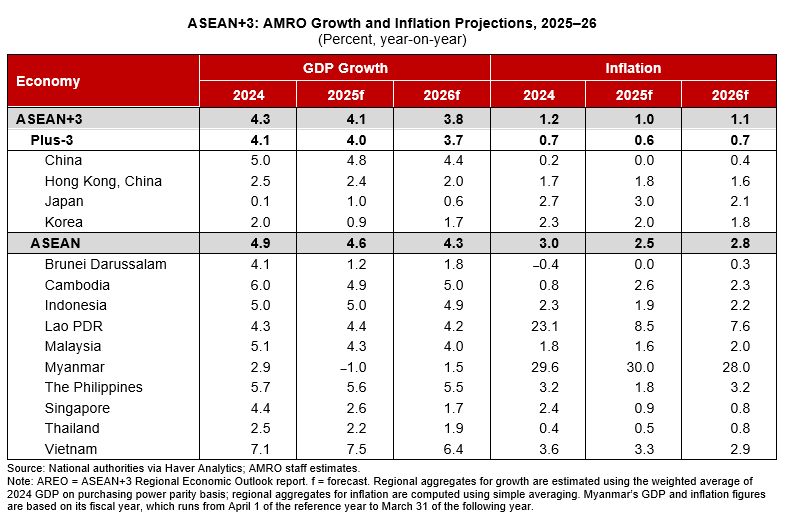

Growth in the ASEAN+3 region is projected at 4.1 percent in 2025 and 3.8 percent in 2026, an upward revision from July’s forecast, supported by robust first-half performance and stronger-than-expected export momentum. Market pressures have gradually eased since peaking in April following the announcement of the “Liberation Day” tariffs.

“While intra-regional trade and domestic demand have become increasingly important growth drivers across ASEAN+3, the region remains deeply connected to the global financial system and is therefore not insulated from global shocks,” said AMRO Chief Economist Dong He. “Overall, the region’s financial system remains resilient, although pockets of vulnerabilities persist.”

Export-oriented corporate sectors—particularly smaller firms with high exposure to US demand—may face pressures on profit margins amid shifting trade dynamics. Inflation pressures in the US could persist amid higher import tariffs, complicating the Fed’s monetary policy stance and potentially triggering spillovers to other parts of the world. Additionally, growing uncertainty around the US dollar’s safe-haven status could further fragment the global financial landscape.

Despite these challenges, ASEAN+3 economies remain well-positioned to navigate global headwinds. Well-calibrated policy mixes and strong fundamentals—including robust banking systems, deepening financial markets, ample foreign reserves, and available policy space—have provided critical buffers. With inflation largely subdued and expectations well-anchored in most economies, central banks can maintain accommodative monetary policy to support growth.

At the same time, macroprudential tools, along with foreign exchange and capital flow management measures, offer additional safeguards to maintain financial stability and mitigate external spillovers. However, AMRO underscores that support should be carefully targeted to vulnerable sectors and deployed prudently to preserve policy space amid elevated external uncertainty.

Beyond near-term risks, the region is undergoing deeper structural transitions. Most notably, the rapid digitalization of financial services presents opportunities for greater financial inclusion and efficiency, while also introducing new challenges to financial stability.

“Digitalization of the banking sector is reshaping the market structure, offering new pathways for inclusion and efficiency,” said Runchana Pongsaparn, AMRO Group Head for Financial Surveillance. “But it also alters the nature and distribution of financial stability risks. Policymakers must adopt a multi-pronged strategy that promotes innovation while managing risks, calibrated to the maturity of each market segment.”

As ASEAN+3 manages near-term uncertainties, AMRO emphasizes the importance of reinforcing policy frameworks, improving transparency, and deepening domestic markets and buffers to mitigate spillover risks from external shocks.

Dr. He concluded: “With coordinated actions and deeper financial cooperation and integration, ASEAN+3 can turn today’s challenges into tomorrow’s opportunities, and emerge stronger, more connected, and more resilient.”

For more insights, refer to AMRO’s latest flagship publications: the ASEAN+3 Financial Stability Report 2025, and the ASEAN+3 Regional Economic Outlook October Update.

About AMRO

The ASEAN+3 Macroeconomic Research Office (AMRO) is an international organization established to contribute toward securing macroeconomic and financial resilience and stability of the ASEAN+3 region, comprising 10 members of the Association of Southeast Asian Nations (ASEAN) and China; Hong Kong, China; Japan; and Korea. AMRO’s mandate is to conduct macroeconomic surveillance, support regional financial arrangements, and provide technical assistance to the members. In addition, AMRO also serves as a regional knowledge hub and provides support to ASEAN+3 financial cooperation.

source:AMRO